20 Years of the WEEE Directive – So What Now?

envenance on compliance.

The volume of Waste Electrical and Electronic Equipment (WEEE) continues to grow worldwide – and especially within Europe. In 2022, approximately 5 million tonnes of WEEE were disposed of across the EU, including 900,000 tonnes in Germany alone (source).

The EU has been trying to counter this trend since 2005 through the WEEE Directive. An updated version entered into force in 2012. Now, more than ten years after the adoption of Directive 2012/19/EU and almost twenty years after the original 2002 Directive (2002/96/EC), the European Commission has published its evaluation findings on 2 July 2025 (source). The result is sobering: despite some progress, the Directive is still falling short of its own ambitions – two decades in.

Achievements – and Their Limits

According to the Commission’s evaluation, the collection of WEEE increased by around 65% between 2012 and 2021. That sounds like success – but 24 out of 27 EU member states failed to meet their legally defined collection targets. Moreover, 46% of all collected WEEE is still not being properly treated. Instead, it ends up as metal scrap or is illegally exported.

Where the Directive Fails

- Insufficient collection rates: 24 member states have not reached the 85% or 65% targets.

- Poor recycling standards: Only 23% of recycling facilities meet the prescribed EU quality standards.

- Weak enforcement of Extended Producer Responsibility (EPR): Many producers – especially online sellers – continue to neglect their EPR obligations in 2025.

- Disconnection from reality: The Commission claims the 2012 Directive has led to administrative cost savings of €3.8 billion (registrations) and €7.3 billion (reporting obligations) – a claim few market actors would agree with.

What Does This Mean?

Let us be frank: the shortfall in collection targets is not only due to collection volumes but also to poor-quality reporting by producers and the issue of multiple declarations across member states. Role definitions remain ambiguous, and most importantly, a central EPR register still does not exist.

In terms of market enforcement, the picture is equally bleak. From a compliance service perspective, affected companies are often referred to watchdog associations or EU competition law as the only “real” enforcement mechanisms – because effective EPR market surveillance is either non-existent or invisible in most countries.

The Commission’s claim that the WEEE-2 Directive has reduced administrative costs is frankly baffling. The numbers may be well calculated – but the real savings potential is likely far greater and still unrealized. And that’s the point: we’re measuring success against the wrong benchmarks.

EU Value – and an Agenda for the Future

There’s no question: the WEEE Directive has raised awareness and created a foundational framework over the past 20 years. It aligns with the EU’s Circular Economy Action Plan and the broader ambitions of the Green Deal. It has even inspired similar legislation in countries like Turkey, India and Singapore.

Yet, from the start, the Directive has been chasing its own tail. Collection and recycling targets are regularly missed. Recycling quality remains inconsistent. And the administrative burden on producers continues to grow.

A core part of the problem lies in how data is gathered and exchanged. Companies still wrestle with redundant reporting, unclear responsibilities, and fragmented national systems. Here, the subsidiarity principle becomes a regulatory roadblock.

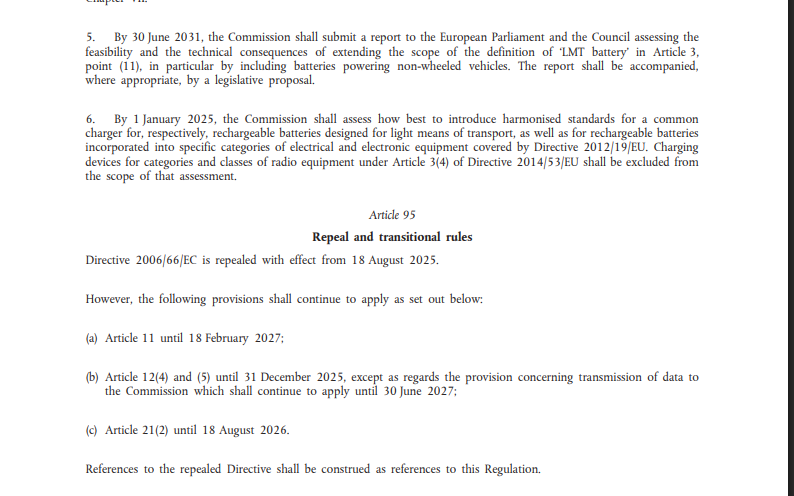

And replacing the WEEE Directive with a Regulation won’t automatically fix the issue either – as early experiences with the Battery Regulation (EU 2023/1542) and the Packaging and Packaging Waste Regulation (PPWR, EU 2025/40) clearly show this.

What Would Actually Help?

To establish a leaner and more effective system, we need a paradigm shift:

- A single central EPR register at EU level, linked directly to national compliance schemes

- Standardised data formats and reporting cycles, submitted once to one location

- Abolition of national authorised representatives, replaced by automatic data transmission from the central register

- Real-time sales data charges via e-invoicing, tied into the EU’s ViDA initiative

- A transparent debate on state vs. private compliance schemes, especially around quality standards and control mechanisms

Such a system could function without disrupting the single market, eliminate costly duplicate registrations, reduce third-party dependencies – and significantly ease compliance burdens.The scope of regulation doesn’t need to grow. The systemic architecture does.

About envenance

As a partner for the sustainable organisation of Extended Producer Responsibility, envenance supports companies in implementing EU requirements and developing structural, long-term compliance solutions. Talk to us – and let’s rethink WEEE, together.